ASIC Miner ICERIVER KAS KS0 Profitability In the realm of cryptocurrency mining, the Iceriver KAS KS0 miner has garnered widespread attention. Tailored specifically for the Kaspa network's KHeavyHash algorithm, it boasts high hashing power and low power consumption, making it an ideal choice for many miners. In this article, we will comprehensively assess IceRiver KS0 profitability while considering the Kaspa market conditions and the attributes of KS0 miner. Kaspa Market Dynamics Kaspa is a vibrant cryptocurrency network aimed at delivering high performance and scalability for everyday transactions. At the time of writing this article, the Kaspa coin trades at approximately $0.04959. But it's essential to note that cryptocurrency markets are highly susceptible to price volatility. Hence, investors must remain vigilant about market dynamics. Additionally, the Kaspa network's mining difficulty and reward mechanisms play a role in mining returns. Attributes of the IceRiver KS...

How to choose a miner to get the most profit?

The first thing a miner friend mines is how to choose the right miner rig. This involves several issues:

When to buy miners, what price, and what type of miners.

When to buy miners

Bitcoin has an apparent bull-bear cycle. Buying miners is like buying coins. The timing of entry is essential. Miners' prices are often inflated when buying miners at the bull market's top. For example, the Antminer S9 was even sold at the end of 2017. Around $4,800. At this time, once you encounter a slump in the bear market, the payback will be indefinite. But if you buy miners when the bears are turning bulls, you can not only buy cheap miners, even miners whose cost prices have fallen below the cost. When the currency price rises in the subsequent bull market, the miners' income increases sharply, the payback time will be rapidly shortened, and the miner rigs' price will also increase. The price of Antminer S9 plummeted with the big bear market in 2018 and eventually even fell to one or two hundred dollars a unit. At that time, those who decisively bought the miners' bottom had a good harvest in the mid-2019 round of the bull market.

The price of buying miners

When buying a miner, there are two ways to evaluate whether the miner's price is reasonable, one is to calculate the number of days to return to the original cost, and the other is to evaluate the cost of the miner. The number of static return days is precise at a glance and easy to calculate. However, when the currency price soars, the number of return days is significantly shortened, giving people the illusion that they can make a lot of money. Once the currency price plummets, the return period will increase sharply, so it must be Be cautious. When evaluating the cost of miners, if the price is much higher than the cost of miners, it often means that there is a big bubble in the market, and you must be careful at this time. When the price of miners drops sharply or even falls below the cost price, it is difficult to increase the hash rate of the entire network at this time, but it is a better time to buy.

What type of miners to buy

A significant indicator for miners is the proportion of electricity bills in mining. If the proportion of electricity bills reaches 100%, it is recommended that miners shut down directly. Suppose a miner’s electricity bill accounts for a lower proportion. In that case, its shutdown probability will be lower, and the more it will withstand the risk of a collapse in currency prices. Therefore, miners with lower electricity bills are more insured and live longer. For stability, it is recommended to buy miners with lower electricity bills.

However, miners with a low proportion of electricity bills are also more expensive, and the number of static payback days is generally longer. In addition, when the currency price rises, the rate of return for miners with a low proportion of electricity purchases will be higher.

Taking Antminer S17 Pro, Whatsminer M20S, and M21S as examples, their electricity bills accounted for higher proportions. Still, their payback periods were 11317.8÷31.71≈357 days, 12644.22÷34.49≈367 days, 8599.78÷24.67≈349 days. It can be seen that the price of M21S is lower, and the payback is faster. Although no other miners are durable, it makes the most money quickly, and the currency price rises also benefit the most. However, once the halving is completed, the mining revenue will decrease. At this time, M21S may not be as good as S17 Pro, which has a low electricity bill. What kind of miner to buy requires users to consider various aspects of their investment strategy and market development and the risks and benefits of the current mining market.

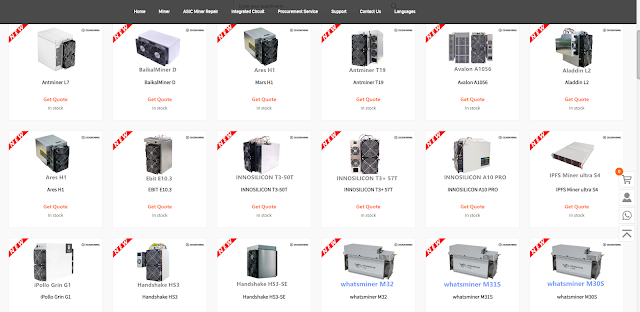

In recent days, miner manufacturers have also launched some new miners with better performance and a lower proportion of electricity bills. In November, Bitmain launched the Antminer L7 with a robust hash rate of 9.5Gh/s and power consumption of 3425W. Its hash rate is equivalent to the hash rate of 20 Antminers L3+. Interested friends can contact ZEUS MINING sales manager to inquire about purchases.

However, miners with a low proportion of electricity bills are also more expensive, and the number of static payback days is generally longer. In addition, when the currency price rises, the rate of return for miners with a low proportion of electricity purchases will be higher.

Taking Antminer S17 Pro, Whatsminer M20S, and M21S as examples, their electricity bills accounted for higher proportions. Still, their payback periods were 11317.8÷31.71≈357 days, 12644.22÷34.49≈367 days, 8599.78÷24.67≈349 days. It can be seen that the price of M21S is lower, and the payback is faster. Although no other miners are durable, it makes the most money quickly, and the currency price rises also benefit the most. However, once the halving is completed, the mining revenue will decrease. At this time, M21S may not be as good as S17 Pro, which has a low electricity bill. What kind of miner to buy requires users to consider various aspects of their investment strategy and market development and the risks and benefits of the current mining market.

In recent days, miner manufacturers have also launched some new miners with better performance and a lower proportion of electricity bills. In November, Bitmain launched the Antminer L7 with a robust hash rate of 9.5Gh/s and power consumption of 3425W. Its hash rate is equivalent to the hash rate of 20 Antminers L3+. Interested friends can contact ZEUS MINING sales manager to inquire about purchases.

So, have you chosen your favorite miner?

Comments

Post a Comment

Tell us your opinion